This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2020, the equipment must be financed or purchased and put into service between January 1, 2020 and the end of the day on December 31, 2020.

What is the Section 179 Deduction

Most people think the Section 179 deduction is some mysterious or complicated tax code. It really isn’t, as you will see below.

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Several years ago, Section 179 was often referred to as the “SUV Tax Loophole” or the “Hummer Deduction” because many businesses have used this tax code to write-off the purchase of qualifying vehicles at the time (like SUV’s and Hummers). But that particular benefit of Section 179 has been severely reduced in recent years (see ‘Vehicles & Section 179‘ for current limits on business vehicles.)

However, despite the SUV deduction lessened, Section 179 is more beneficial to small businesses than ever. Today, Section 179 is one of the few government incentives available to small businesses, and has been included in many of the recent Stimulus Acts and Congressional Tax Bills. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much needed tax relief for small businesses – and millions of small businesses are actually taking action and getting real benefits.

How much money can Section 179 save you in 2020?

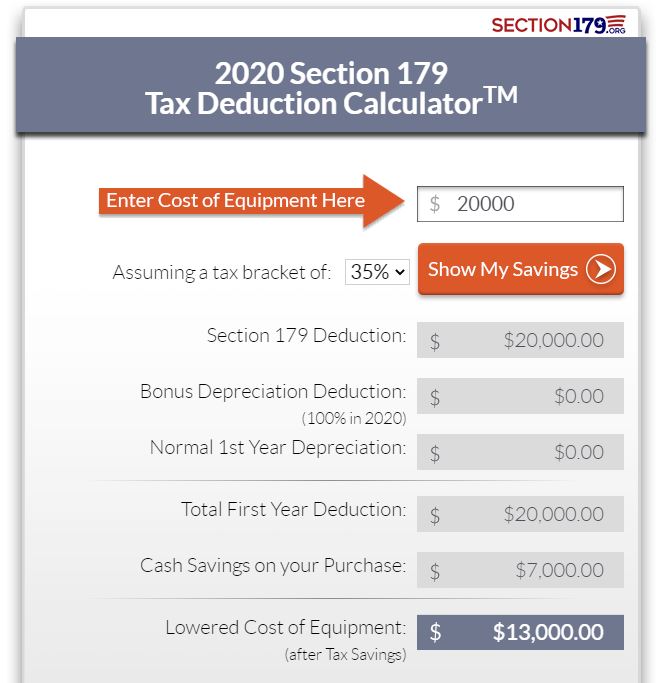

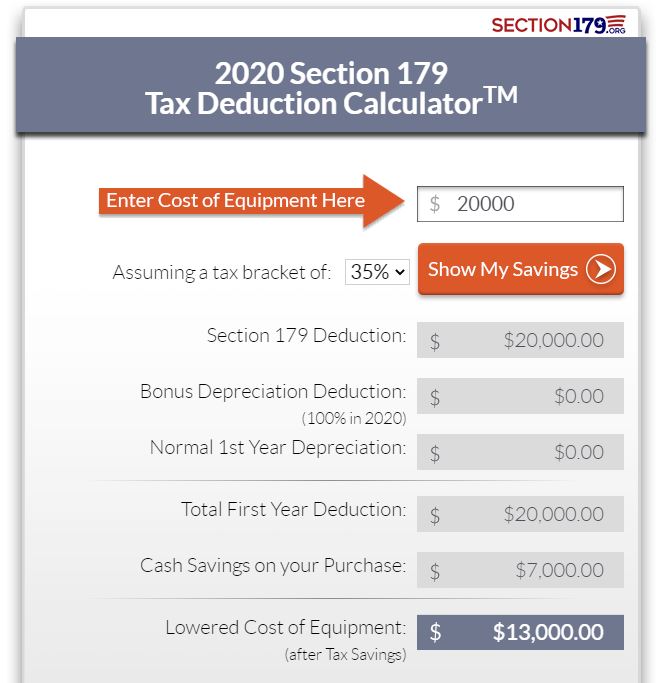

The Section 179 Deduction has a real impact on your equipment costs. Here’s an easy to use calculator that will help you estimate your tax savings. Simply enter in the purchase price of your equipment and/or software, and let the calculator take care of the rest.

Please note that this Section 179 Calculator fully reflects the current Section 179 limits and any and all amendments / bonus depreciation.

https://www.section179.org/section_179_calculator/